Just a quick note to offer some perspective on the (many) headlines floating around.

There are almost too many things to be worried about right now, so I’d like to pause for a second to remember the abundance in our lives.

Especially when so many folks are suffering.

When the world stresses me out, I remind myself to be grateful for what I have.

What's your go-to for uncertain times?

Ok, let's dive in.

(Not in the mood for economic stuff? Scroll down to the P.S. for a mental snack.)

Are we in a bear market?

In some sectors, yes, stocks have dropped more than 20% from their last peak, which is the technical definition of a bear market.1

So, we're in bear territory, at least.

But, as of this writing, the broader S&P 500 has not entered a bear market. It might, of course.

That’s absolutely possible in this environment.

So, let’s remember that we’re not day traders.

We’re long-term investors, and the day-to-day and week-to-week gyrations aren’t as important as what happens over years.

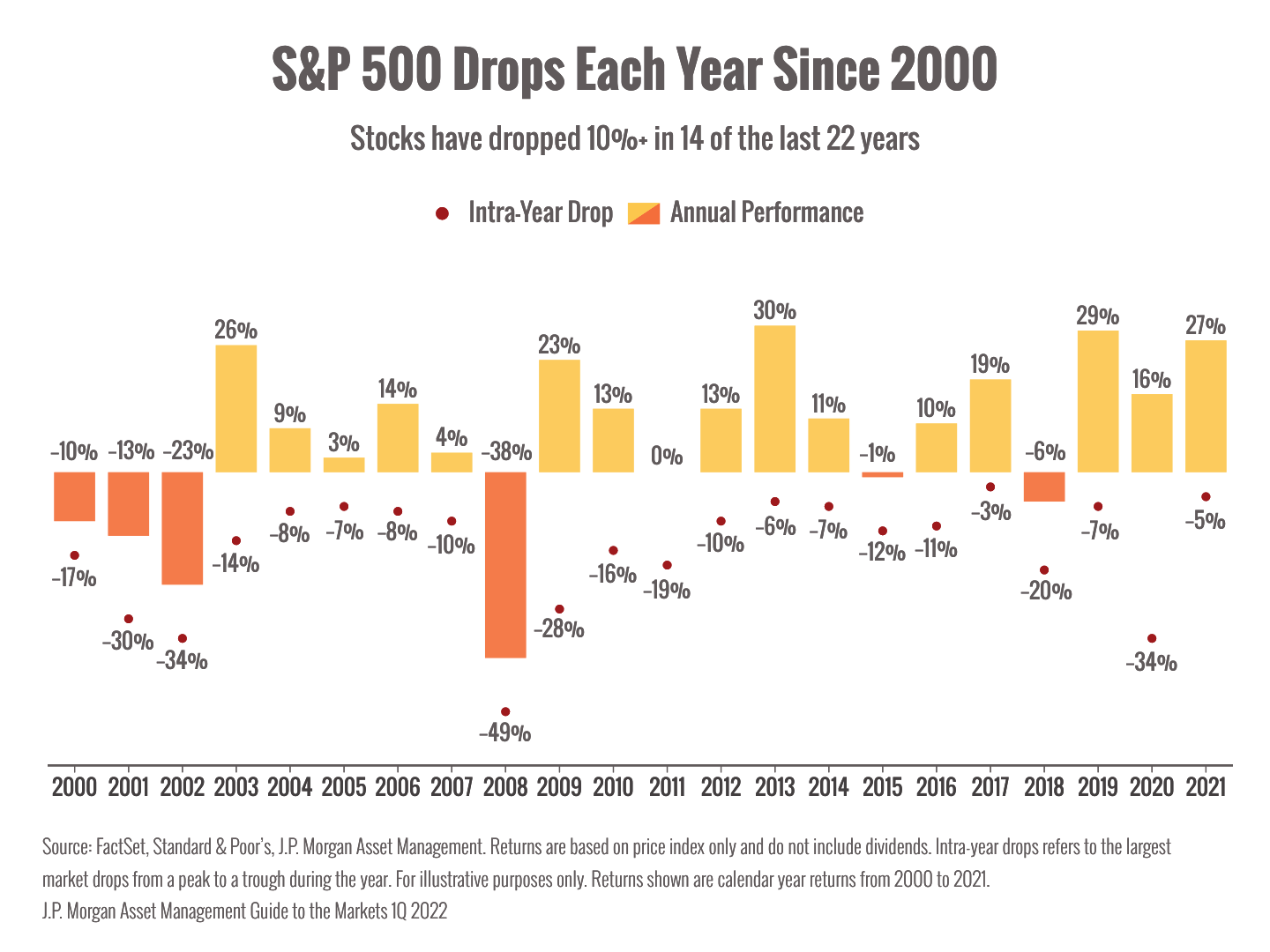

Here’s a quick chart showing just how common big market drops are:2

Is another financial crisis imminent?

The professional economists who study these things don't think so.

Russia's economy is definitely in trouble and the country may default on its debt repayments. While that's not good news for the banks and institutions that are owed money, the debts are not enough to put the whole financial system at risk.3

What about inflation?

Inflation’s definitely a worry right now.

Before Russia's brutal invasion, the Fed had planned to kick off a series of rate hikes this month to bring inflation down.

Their policymakers were counting on smoother supply chains and a return to greater normalcy to help offset the impact of higher rates.4

Now, however, higher energy and commodity costs, as well as more shipping disruptions caused by the war, mean inflationary pressures are even greater and could send prices higher this year.

That means the Fed has a very tricky path to guide inflation lower without spooking markets or triggering a recession. It’s possible Fed leaders will choose a slower pace for their rate hikes amid the uncertainty.5

So, let’s talk about the big “R.”

Is a recession coming?

That’s really hard to say with so many unknowns.

Currently, economists don’t think a U.S. recession is likely, but the risk is definitely on the horizon.6

Inflationary pressures, consumer expectations, and funky interest rate patterns (called an inverted yield curve) could be flashing warning signs.

Does that mean a recession is certain? Definitely not.

Is it a risk worth watching? Absolutely. So we will.

There’s a lot of uncertainty swirling. So, forecasts and predictions are not very accurate or useful.

Instead, we focus on the very few things that are within our control: our strategies, our reactions, and our compassion for ourselves and others.

P.S. A mental snack: A lot of us think creativity is something only certain people are born with. Turns out, researchers say creative thinking can be trained by teaching yourself to imagine radically different possibilities and perspectives. Kind of how writers and artists create fictional worlds and stories.

Why is this important? I think there's a lot of existential anxiety floating around our changing world. Training ourselves to think creatively and be open to possibility is (in my humble opinion) a great way to fight anxiety and embrace uncertainty. What do you think?

4 - https://www.wsj.com/articles/ukraine-war-oil-gas-prices-inflation-federal-reserve-11647268257?mod=hp_lead_pos5

Wall Street Journal - The Inflation Hits Just Keep Coming, Raising Stakes for the Fed

6 - https://www.ft.com/content/d8e60667-0379-4323-9b74-dbbf5a043e38

Financial Times - A US Recession is on the Table